NOC from concerned authorities of Electricity and Gas suppliers in case of loan disbursement

NOC from concerned authorities of Electricity and Gas suppliers in case of loan disbursement Entrepreneurship Support Fund (ESF)

Entrepreneurship Support Fund (ESF) Startup Fund Bangladesh Bank

Startup Fund Bangladesh Bank LEED Certification Procedures for Industrial Green Building

LEED Certification Procedures for Industrial Green Building Bangladesh: A New Horizon For Investment

Bangladesh: A New Horizon For Investment Focus on raising private sector investment for GDP growth

Focus on raising private sector investment for GDP growth Duty Free Quota Free export items to China

Duty Free Quota Free export items to China Bangladesh’s $50bn RMG export target

Bangladesh’s $50bn RMG export target Export of jute stick charcoal fetches Tk 140m from China

Export of jute stick charcoal fetches Tk 140m from China Investment scenario of Bangladesh

Investment scenario of Bangladesh

CMSME Refinance Scheme

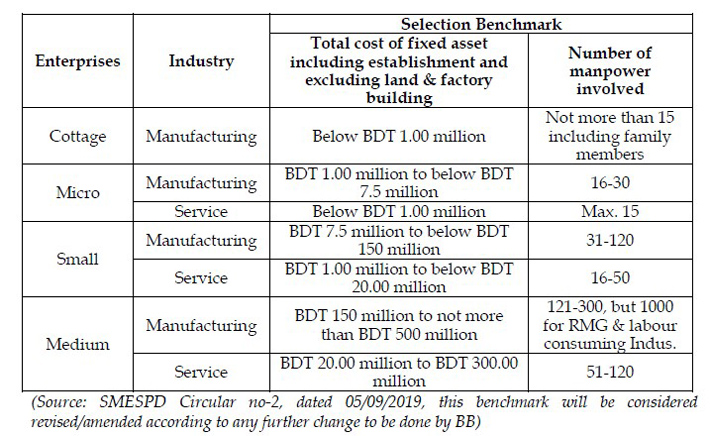

CMSME REFIANCE SCHEME

Cottage, Micro, Small and Medium Enterprises (CMSMEs) are considered as a potential sector for resolving unemployment problem. This sector has been playing a significant role for achieving economic growth and earning foreign currency by encouraging and expanding the business activities. With a view to enhancing the living standard of the mass people, to ensure women empowerment along with reducing gender discrimination for the development of this sector.

The specific details of any refinance scheme offered by the Bangladesh Bank can vary depending on the prevailing economic conditions, government priorities, and the needs of the targeted sectors. These schemes may include provisions for subsidized interest rates, flexible repayment terms, and other incentives designed to encourage borrowing and investment in priority areas.

Here are some key types of CMSME Refinance Schemes:

- Small Enterprise Refinance Scheme for Women Entrepreneurs

- Setting up Agro Based Product Processing Industries Refinance Scheme

- New Entrepreneurs' in Cottage, Micro and Small Enterprise Sector.

- Shariah Based financing in 'Agro-Based Industry', Small Entrepreneurs' (Including Women Entrepreneur) and New Entrepreneurs' in Cottage, Micro & Small Enterprise Sector.

The CMSME (Cottage, Micro, Small, and Medium Enterprises) Refinance Scheme in Bangladesh offers several facilities aimed at providing financial support to these sectors. Here are the key features and facilities of the CMSME Refinance Scheme:

- Total amount of fund: As in Bangladesh Bank's Circular

-

Loan Allocation and Fund Distribution:

Banks and financial institutions are mandated to distribute

- Manufacturing and Services Vs Business:

- Manufacturing and services sectors at least 70%

- Business sector with a maximum of 30%

- CMS Enterprise Vs Medium Enterprise:

- Cottage, micro, and small entrepreneurs minimum of 75%

- Medium enterprises with the remaining 25%

Figure can vary depending on Bangladesh updated Bank's circular from time to time

- Manufacturing and Services Vs Business:

-

Loan Profile:

- Interest Rate: Interest rate at 7% (In case of women entrepreneur it may vary).

- Loan Tenure: The total loan tenure, including the grace period, can extend up to 5 (five) years.

- Grace Period: A grace period of up to six months for the borrowers.

-

Special Considerations:

- Defaulting Borrowers: Borrowers with a history of default are not eligible to receive loans under this scheme.

- Women Entrepreneurs and Special Needs: Loans under this scheme give priority to women entrepreneurs, entrepreneurs with special needs, and those affected by disasters.

High priority sector

- 1. Agriculture/food processing and agricultural machinery manufacturing industries

- 2. Ready made garment industry

- 3. ICT/Software Industry

- 4. pharmaceutical industry

- 5. Leather and Leather Products Industry

- 6. Light engineering industry

- 7. Jute and jute industries

Priority sectors

- 1. Plastic industry

- 2. Foreign employment

- 3. Shipbuilding industry

- 4. Environmentally friendly ship recycling industry

- 5. tourism industry

- 6. Frozen Fisheries Industry

- 7. Home textile goods industry

- 8. Renewable Energy (Solar Power, Wind Mill)

- 9. Active Pharmaceutical Ingredient Industry and Radio Pharmaceutical Industry

- 10. Herbal medicine industry

- 11. Radioactive (irradiation) application industries (eg quality improvement of degradable polymers/food-grain preservation/medical equipment sterilization industries)

- 12. Polymer manufacturing industry

- 13. Hospitals and clinics

- 14. Automobile manufacturing and repair industry

- 15. Handicrafts and handicrafts

- 16. Energy Saving Appliances (LED, CFL Bulbs Manufacturing)/ Electronic Equipment Manufacturing Industry/ Electronic Materials Development

- 17. tea industry

- 18. Seed industry

- 19. Jewellery

- 20. toys

- 21. Cosmetics and Toiletries

- 22. Agar industry

- 23. Furniture industry

- 24 Cement industry

List of agro-based activities and Agro-products/Food processing industries

- 1.Processed fruit foods (jams, jellies, juices, pickles, sherbets, syrups, sauces etc.)

- 2. Processing of fruits (tomato, mango, guava, sugarcane, jackfruit, litchi, pineapple, coconut etc.), vegetables, pulses

- 3. Processing of Bread and Biscuits, Semai, Lachcha, Chanachur, Noodles etc

- 4. Preparation of rice, flour, flour, semolina

- 5. Automatic Rice Mill (Auto Rice Mill)

- 6. Mushroom and Spirulina (Spirulina) processing

- 7. Production of starch, glucose, dextrose and other starch products, corn processing

- 8. Dairy processing (milk pasteurization, milk powder, ice cream, Condensed milk, sweets, cheese, butter, ghee, chocolate, curd etc.)

- 9. Production of processed foods (chips, potatoes, flakes, starch etc.) from potatoes

- 10. Production of various powdered spices

- 11. Edible oil refining and hydrogenation

- 12. Salt processing

- 13. Processing and freezing of shrimp and other fish

- 14. Preparation of herbal and herbal cosmetics (Cosmetics).

- 15. Preparation of Unani Ayurvedic medicine

- 16. Preparation of balanced feed for poultry and livestock and fish

- 17. Seed production, research, processing and storage

- 18. Manufacture of jute products (eg rope, yarn, twine, mats, bags, carpets, jute sandals etc.)

- 19. Manufacture of silk textiles and textiles

- 20. Agricultural machinery manufacturing industry

- 21. Preparation of Muri, Chira, Khai etc

- 22. Aromatic rice production

- 23. Tea processing

- 24. Preparation of coconut oil (if copra collected from indigenous coconuts is used)

- 25. Rubber Tape, Lakshma Processing

- 26. Cold Storage (Processing and Storage of Farmers Produced Food Potatoes and Seed Potatoes, Fruits, Vegetables)

- 27. Manufacture/manufacture of wood, bamboo and rattan furniture (except cottage industries) and manufacture of coppersmith's tools

- 28. Preservation and export of flowers

- 29. Meat processing

- 30. Manufacture of organic fertilizers, mixed fertilizers, granular urea etc

- 31. Manufacture of bio-pesticides, neem derived pesticides etc

- 32. Beekeeping/honey making

- 33. Particle board

- 34. Sugar and other sweetening products

- 35. Soyfood Production and Soybean Processing

- 36. Mustard oil manufacturing industry (if domestic mustard is used)

- 37. Rice bran well

- 38. Project for manufacturing of rubber products

- 39. Seed Industry

- 40. Processing and marketing of dairy and poultry products

- 41. Horticulture, floriculture, floriculture, marketing of flowers and vegetables (this industry will include lemons, mushrooms, betel leaves, honey etc.)

List of the Service sectors

Applying for a CMSME (Cottage, Micro, Small, and Medium Enterprises) loan in Bangladesh typically requires a set of standard documents. These documents help banks and financial institutions assess the creditworthiness and business viability of the applicant. Here are some common required documents for a CMSME loan application:

-

Business Registration Documents:

- Trade license or business registration certificate

- Partnership deed (for partnerships)

- Memorandum and Articles of Association (for companies)

- VAT

- IRC and ERC

-

Identification Documents:

- National ID card or passport of the business owners

- Recent passport-sized photographs of the business owners and Guarantors

-

Financial Documents:

- Recent financial statements (balance sheet, income statement, cash flow statement)

- Bank statements for the past 1-3 years

- Tax return documents with E-Tin

-

Business Plan or Project Proposal:

- Detailed business plan outlining the purpose of the loan, expected benefits, and repayment plan

- Projected financial statements (profit and loss forecast, cash flow forecast)

-

Collateral Documents (if applicable):

- Land ownership documents or lease agreement

- Details of collateral offered (property deed, Stocks of goods with Market value, etc.)

- Valuation report of the collateral

-

Proof of Address:

- Utility bills (electricity, water, gas) in the name of the business or business owner

- Lease or rental agreement for the business premises

-

Legal Documents:

- CIB Undertaking Form

- Any existing loan agreements or debt obligations

- No Objection Certificate (NOC) from existing lenders, if applicable

-

Other Supporting Documents:

- Quotations or invoices for equipment or inventory to be purchased with the loan

- Proof of experience in the business or sector (e.g., previous contracts, references)

Banks and financial institutions may have specific requirements or additional documents needed based on their internal policies and the nature of the business. Therefore, it is advisable to contact the specific bank or financial institution for a detailed checklist.

For more detailed guidance, click the below link