Building a digital economy for bangladesh

Building a digital economy for bangladesh Entrepreneurship Support Fund (ESF)

Entrepreneurship Support Fund (ESF) Startup Fund Bangladesh Bank

Startup Fund Bangladesh Bank LEED Certification Procedures for Industrial Green Building

LEED Certification Procedures for Industrial Green Building Bangladesh: A New Horizon For Investment

Bangladesh: A New Horizon For Investment Focus on raising private sector investment for GDP growth

Focus on raising private sector investment for GDP growth Duty Free Quota Free export items to China

Duty Free Quota Free export items to China Bangladesh’s $50bn RMG export target

Bangladesh’s $50bn RMG export target Export of jute stick charcoal fetches Tk 140m from China

Export of jute stick charcoal fetches Tk 140m from China Investment scenario of Bangladesh

Investment scenario of Bangladesh

Equity & Entrepreneurship Fund of Bangladesh Bank

The Equity and Entrepreneurship Fund (EEF) of Bangladesh Bank was established to provide equity support to new ventures in the agro-based, food processing, and information technology sectors. Introduced in the fiscal year 2000-2001, the fund aims to promote investments in these promising yet risky sectors. Projects eligible for EEF support must be new and technically and financially viable, with specific criteria for private limited companies. The fund can cover up to 49% of the total equity of a project

Equity and Entrepreneurship Fund (EEF) was formed to encourage the investors to invest in the risky but otherwise promising two sectors, viz. software industry andfood processing and agro-based industry. Bangladesh bank is authorized by the Government tomanage the EEF. This fund was started to increase investments in two promising industrial sectorsviz. Software industry and Food processing and agro-based industry (excluding the conventional sub-sectors such as rice mills/flour mills/fishing trawlers, cold storage of potato etc.) and also toencourage entrepreneurs in these sectors.

Entrepreneurship Support Fund (ESF): EEF was a great initiative of the Government to promote specific sectors under specific conditions. Considering all the recommendations and findings of various surveys on the performance of EEF and workshops with the participation of Government, Bangladesh Bank and all the stakeholders, in 2017, the decision was taken to introduce a debt model with simple interest at a tolerable level instead of existing equity model in managing this generous scheme of the government. As a result, the name of EEF was changed to ESF (Entrepreneurship Support Fund) in 2017 and through EEF Circular No-35/2018 on 05 August 2018 ESF Policy, 2018 was issued.

- Type of Sectors: Agro-based Industries or IT-based Enterprise

- Type of Facility: Term Loan

- Project Cost: BDT from Min 0.50 Crore to Max 12 Crore (For IT 5 Crore (Max)

- Equity and Debt Ratio: 51% : 49%

- Formation of the Company: RJSC&F registered company

- Nationality: Any Bangladeshi (NRB Entrepreneur will be prioritized)

- Entrepreneur's Financial Capability: Assets as in IT 10B of tax return

- Loan Profile:

- Interest of Loan: 2% (on Term Loan)

- Tenure of Loan: 8 Years

- Moratorium/Grace Period: 4 Years

- Repayment schedule: Within the next 4 (four) years by 8 (eight) six-monthly equal installments.

- Other Consideration: Defaulter and loan availing company are not allowed

The figures above are subject to revisions in Bangladesh Bank's latest circular changes from time to time.

Eligibility for the Equity Support Fund

- The project will have to be a new one and belong to either of the sectors viz., software industry or food processing and agro-based industry.

- The sponsors/entrepreneurs applying for EEF support will have to be a private limited company registered under the Companies Act, 1994 and established old companies can also apply for EEF support by setting-up a subsidiary new private limited company. But in case of a software company registered on or after 01 January, 1997 will be treated as a new company.

- The total project cost ( including net working capital ) of the proposed project will have to be of minimum 0.50 (half) core for both IT and agro-based industries and that of the maximumis Taka 5.00 Crore for IT& Taka 12.00 Crore for agro-based industries. Project proposal with bank loan is not allowed for agro –based industries but allowed for IT industries.

- The project shall have to be viable technically & financially. It should be environment friendly. Importance shall be given on the appraisal of the entrepreneurship such aseducational qualification in the relevant discipline, knowledge in the technology/processoperating such project, track records in financial conduct specially with Banks/FI. In case of ratio analysis the project has to offer minimum IRR (Internal Rate of Return) of 15%, Returnon equity (ROE) of 15% Debt service coverage Ratio 1.50:1 Current ratio 1.50:1 and Fixedasset coverage ratio 1.50: 1 and SWOT analysis should have to be acceptable.

- The non-resident Bangladeshis will be given preference subject to the fulfillment of the terms& conditions mentioned in the above paragraphs.

- Any defaulter (as defined by Bangladesh Bank) cannot apply for EEF.

- Where a sponsor of a project needs term-loan and /or working capital loan from any Bank/FI and also equity support form the EEF, he has to submit application to the Bank/FI concerned.The Bank/FI will have to be satisfied that the project has fulfilled all the terms and conditionsrequired. Where the sponsors/entrepreneurs need only equity support from EEF without any bank loan a Bank/FI will be nominated as representative of EEF for appraisal of the project by Bangladesh Bank (EEF). To nominate such Bank/FI, previous business relationship of entrepreneur with the Bank/FI will be considered. The concerned Bank (which will also actas monitoring bank) will make thorough appraisal of the project in accordance with EEF

Process flow of the ESF:

The fund can be availed by an investor as per the following process flow subject to compliance of existing policy at each stage:

- Submission of Expression of Interest (EOI) | Expression of Interest (EOI) Form |

- Food processing and Agro-based Industry: Fill up EOI form online ? Submit a nonrefundable pay order/bank draft of Tk 2000.00 directly/by post/by courier to the address of EEF Unit, Bangladesh Bank with a print copy of EOI.

- ICT Based Industry: Collect EOI from ICB against a nonrefundable Pay order/Bank Draft of Tk.2000.00 ? Submit duly filled EOI directly/by post/by courier to ICB.

- Accumulation of EOIs in ICB: Sending EOIs of food processing and agro-based industries filed with Bangladesh Bank to ICB

- Presentation of applications to Project Appraisal Committee (PAC) by ICB.

- Interviewing and short listing entrepreneurs.

- Submission of Project Appraisal Report to ICB by the shortlisted entrepreneurs through any of the appraising Bank/FI.

- Submission of Appraisal Reports to the concerned PAC to ascertain the technical and financial feasibility of the proposed project.

- Instructions sent to appraising Bank/FI to submit final assessment report for feasible projects.

- Registration of the feasible project under RJSC as Private Limited Company by the entrepreneurs of Food processing and Agro-based Industry. ICT based companies are eligible to apply for ESF loan having completed at least one year period since registration at RJSC as a private limited company.

- Submission of final Assessment Report to ICB by appraising Bank/FI.

- Presentation of final assessment reports before PAC to have recommendation for approval.

- Submission of recommended project proposals to Sanction Board for final approval.

- Issuance of sanction letter. (ESF loan sanction process flow chart.)

- Documentation:

- Mortgaging required collateral by the entrepreneur in favor of ICB.

- Charge creation at RJSC in favor of ICB

- All other documentation requirements according to the sanction letter.

- Verification of entrepreneur's investment (51% of the project cost) through joint inspection of ICB, appraising institution and BB.

- Disbursement of ESF loan (49% of project cost) in 3-4 installments confirming entrepreneur's adequate investment.

- Issuance of loan repayment schedule after full disbursement.

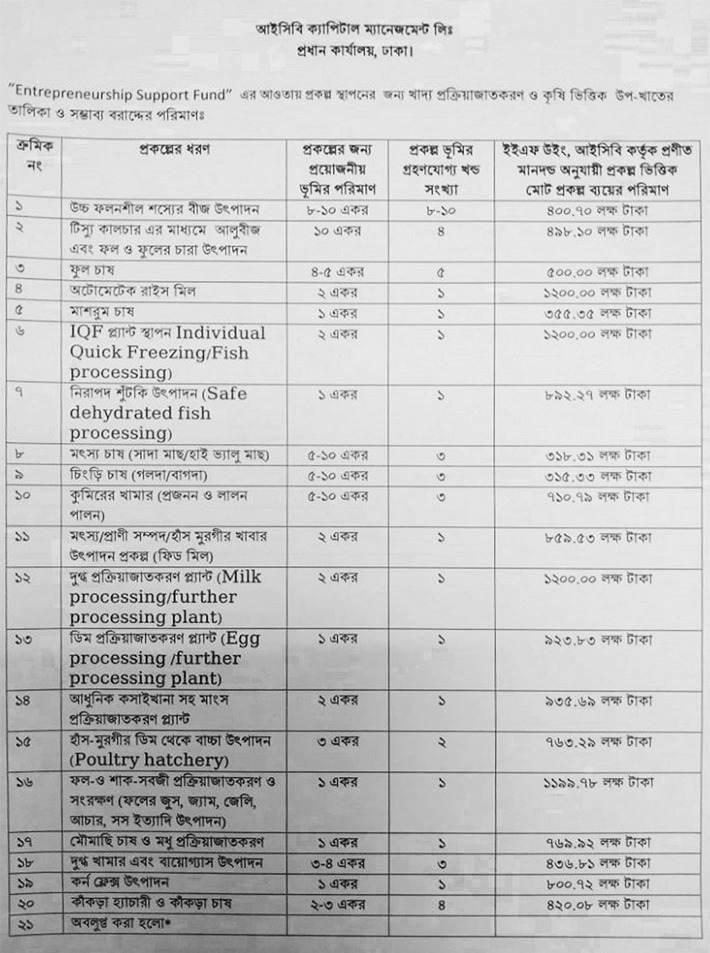

List of Food Processing and Agro-based Sub-Sectors for setting up projects under "ESF".

- Production of high yielding crop seeds

- Production of potato seeds and fruit and flower seedlings through tissue culture

- Cultivation of flowers

- Automatic Rice Mill

- Mushroom cultivation

- Setting up IQF plant (Individual Quick Freezing/Fish processing)

- Safe dehydrated fish processing

- Fisheries (White Fish/ High Value Fish)

- Prawn Farming (Galda/Bagd)

- Crocodile farm (breeding and rearing)

- Fisheries/Livestock/Poultry Feed Production Scheme (Feed Mill)

- Milk processing/further processing plant

- Egg processing plant

- Meat processing plant with modern slaughterhouse

- Poultry Hatchery

- Processing and preservation of fruits and vegetables (Production of fruit juice, jam, jelly, pickle, sauce etc.)

- Beekeeping and honey processing

- Dairy farming and biogas production

- Corn flakes production

- Crab Hatchery and Crab Farming

- Abolished. *

- Value Added Fish Product Development & Marketing

- Oilseed Processing

- Turkey (Genus-Meleagris) Rearing (Meat and Egg Production)

- Turkey Hatchery

- Semi-Intensive Aquaculture

For related guidance and more information visit: